Real Estate Capital Gains Exemption Rules . Web the following gains are generally not taxable: Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web in simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Gains derived from the sale of a property in singapore as it is a capital gain. Web what are the two rules of the exclusion on capital gains for homeowners? Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Here's the most important thing you need to.

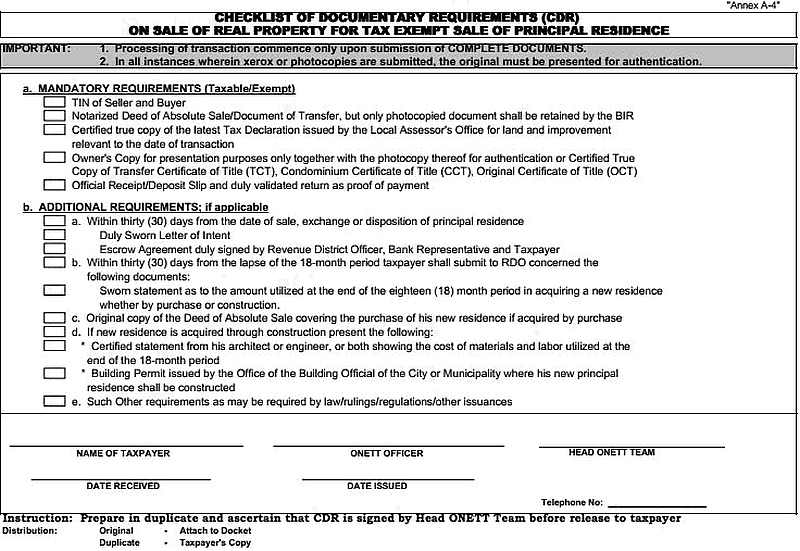

from foreclosurephilippines.com

Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web what are the two rules of the exclusion on capital gains for homeowners? Gains derived from the sale of a property in singapore as it is a capital gain. Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Web in simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Web the following gains are generally not taxable: Here's the most important thing you need to.

How To Get Capital Gains Tax Exemption On The Sale Of Your Principal

Real Estate Capital Gains Exemption Rules Web the following gains are generally not taxable: Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web in simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Web the following gains are generally not taxable: Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web what are the two rules of the exclusion on capital gains for homeowners? Here's the most important thing you need to. Gains derived from the sale of a property in singapore as it is a capital gain.

From www.slideserve.com

PPT CAPITAL GAINS PowerPoint Presentation, free download ID1786253 Real Estate Capital Gains Exemption Rules Gains derived from the sale of a property in singapore as it is a capital gain. Here's the most important thing you need to. Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Web in simple terms, this capital gains tax exclusion enables. Real Estate Capital Gains Exemption Rules.

From www.youtube.com

How to Compute? Capital Gain Tax and Documentary Stamp Tax on Real Real Estate Capital Gains Exemption Rules Web the following gains are generally not taxable: Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from.. Real Estate Capital Gains Exemption Rules.

From exoqsuuzl.blob.core.windows.net

Does Oregon Have A Homeowners Exemption at Andrew Lindsay blog Real Estate Capital Gains Exemption Rules Web in simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web if you have a capital gain from the sale. Real Estate Capital Gains Exemption Rules.

From www.carringtonaccountancy.com

Selling a second home? Beware of the Capital Gains Tax change Real Estate Capital Gains Exemption Rules Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Here's the most important thing you need to. Gains derived from the sale of a property in singapore as it is a capital gain. Web the following gains are generally not taxable: Web what. Real Estate Capital Gains Exemption Rules.

From gingerblanita.pages.dev

2024 Estate Tax Exemption In India Lola Sibbie Real Estate Capital Gains Exemption Rules Web in simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Gains derived from the sale of a property in singapore as it is a capital gain. Web if you have a capital gain from the sale of your main home, you may qualify to. Real Estate Capital Gains Exemption Rules.

From www.lumina.com.ph

Things you Need to Know about Capital Gains Tax Lumina Homes Real Estate Capital Gains Exemption Rules Here's the most important thing you need to. Web the following gains are generally not taxable: Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria. Real Estate Capital Gains Exemption Rules.

From assetyogi.com

Capital Gain on Sale of Land Tax Exemption Rules Real Estate Capital Gains Exemption Rules Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Gains derived from the sale of a property in singapore as it is a capital gain. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of. Real Estate Capital Gains Exemption Rules.

From investguiding.com

Capital Gains Tax on Real Estate And How to Avoid It (2024) Real Estate Capital Gains Exemption Rules Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Gains derived from the sale of a property in singapore as it is a capital gain. Web the following gains are generally not taxable: Web in simple terms, this capital gains tax exclusion enables. Real Estate Capital Gains Exemption Rules.

From sheriyvalaree.pages.dev

Tax Amendment Bill 2024 Malaysia Vally Isahella Real Estate Capital Gains Exemption Rules Web what are the two rules of the exclusion on capital gains for homeowners? Web the following gains are generally not taxable: Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web if you have a capital gain from the sale of your main home,. Real Estate Capital Gains Exemption Rules.

From busapcom.blogspot.com

BIR Form No. 1606 Real Estate Capital Gains Exemption Rules Here's the most important thing you need to. Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web the following gains are generally not taxable: Web what are the two rules of the exclusion on capital gains for homeowners? Gains derived from the. Real Estate Capital Gains Exemption Rules.

From www.lumina.com.ph

Things you Need to Know about Capital Gains Tax Lumina Homes Real Estate Capital Gains Exemption Rules Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria to exclude up to $250,000 for. Web the following gains are generally not taxable:. Real Estate Capital Gains Exemption Rules.

From listwithclever.com

How Capital Gains On Real Estate Investment Property Works Real Estate Capital Gains Exemption Rules Gains derived from the sale of a property in singapore as it is a capital gain. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web the following gains are generally not taxable: Here's the most important thing you need to. Web if you have. Real Estate Capital Gains Exemption Rules.

From www.hegwoodgroup.com

Real Estate Capital Gains Tax 101 Learn From Dallas Tax Consultants Real Estate Capital Gains Exemption Rules Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web the principal residence exclusion is a rule used by. Real Estate Capital Gains Exemption Rules.

From taxrise.com

Capital Gains Tax A Complete Guide On Saving Money For 2023 • Real Estate Capital Gains Exemption Rules Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Gains derived from the sale of a property in singapore as it is a capital gain. Web the principal residence exclusion is a rule used by the internal revenue service that allows people meeting certain criteria. Real Estate Capital Gains Exemption Rules.

From www.relakhs.com

Capital Gains Tax Exemption Options on Sale of Property 202324 Real Estate Capital Gains Exemption Rules Here's the most important thing you need to. Gains derived from the sale of a property in singapore as it is a capital gain. Web what are the two rules of the exclusion on capital gains for homeowners? Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your. Real Estate Capital Gains Exemption Rules.

From www.transformproperty.co.in

Capitalgainstaxinfographic Transform Property Consulting Real Estate Capital Gains Exemption Rules Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Web in simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. Gains derived from the sale of a property. Real Estate Capital Gains Exemption Rules.

From www.dhtrustlaw.com

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt Real Estate Capital Gains Exemption Rules Web what are the two rules of the exclusion on capital gains for homeowners? Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and. Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000. Real Estate Capital Gains Exemption Rules.

From fr.wanakicenter.com

5 Things You Should Know about Capital Gains Tax TurboTax Tax Tips Real Estate Capital Gains Exemption Rules Web if you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from. Gains derived from the sale of a property in singapore as it is a capital gain. Web the following gains are generally not taxable: Web the principal residence exclusion is a rule used by. Real Estate Capital Gains Exemption Rules.